What Is End To End Process Of Accounts Payable

What Is End To End Process Of Accounts Payable

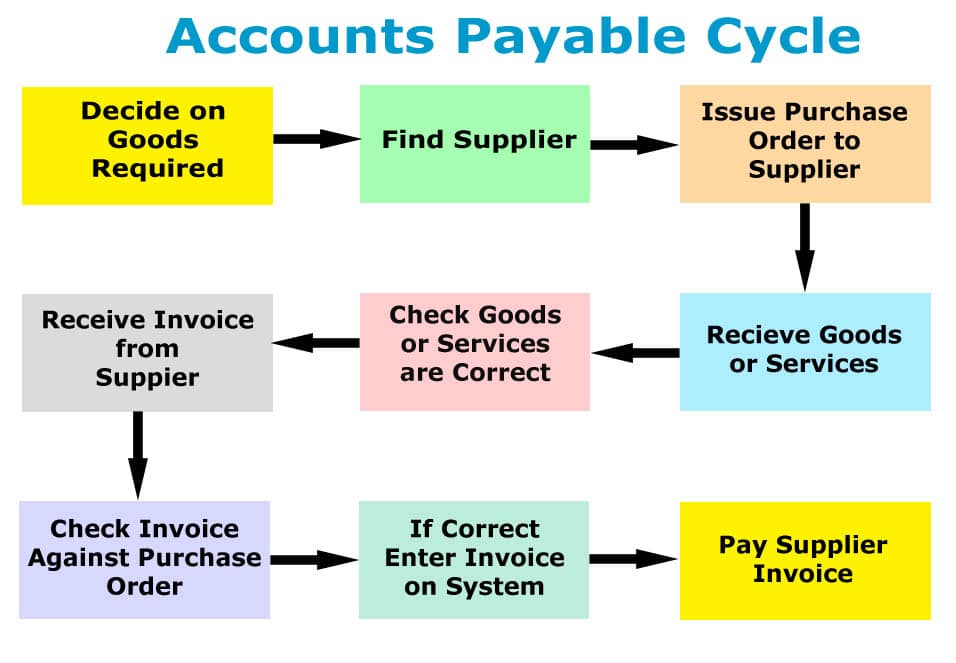

What Is End To End Process Of Accounts Payable The accounts payable (A/P) process is one of the most essential components of a business’s financial operations. Generally speaking, it describes the end-to-end process for tracking all company expenses and managing their payment in an efficient manner. As such, it’s integral to a company’s accounting processes, and understanding the full picture of the A/P process can help companies streamline their expenses and eliminate unintentional overspending.

Step 1: Purchase Order

The A/P process starts with one of the most established techniques in business purchases – the purchase order (PO). This document, issued by a company to its vendors, outlines the details of the proposed purchase: the quantity and quality of the goods or services being procured, the agreed-upon price, payment terms, delivery information, and any special instructions. The issuing company will then wait for a confirmation from the vendor and proceed with the rest of the A/P process.

It’s important for all companies to ensure that the PO is accurately filled out to avoid any issues or confusion later on. If the PO and delivery are not documented and tracked properly, there could be delays in the payment and the vendor could deny any claims due to contractual noncompliance.

Step 2: Receiving the Goods/Services

Once the company receives the products or services ordered, it must verify that they match the description in the PO. This helps to confirm that the vendor is compliant with the contractual agreement and ensures that any delivered goods or services are up to the promised quality. To do this, the company will compare the contents of the shipment with the PO and will often also require the vendor to include a bill of lading or packing slip as a record of the delivery.

Ensuring that the PO information is accurate and accepted by both parties is essential to the A/P process. This helps to avoid discrepancies between the PO and the final payment, and it also ensures that the vendor is inclusive of any associated costs, such as shipping, taxes, and any additional expenses incurred along the way.

Step 3: Invoicing and Approval

Once the goods and/or services have been received, the vendor will issue an invoice to stipulate the final cost and payment terms. This document should always be cross-checked with the PO to ensure that all the agreed-upon details have been followed and that the vendor has not added any unanticipated charges.

At this stage, the invoice will also get final approval by a designated individual or department before being sent off for payment. This is to ensure that the vendor is not overcharging for the delivered goods/services, as well as to make sure that the company is staying within its budgeted spending limit.

Step 4: Entering A/P Data

Once the invoice is approved, the company will enter the corresponding purchase invoice data into its accounts payable system. This system allows for automated record keeping of invoices in order to make it easier to track, manage, and pay them off later. It also provides the company with a robust inventory and costing system, enabling its finance team to accurately assess the company’s spending.

Step 5: Processing Payment

Once the A/P data has been entered into the system, the accounting department can use the data to quickly and accurately process payments. This payment can be sent either via direct deposit or mailed via check, depending on the vendor’s payment preferences. However, in today’s digital world, electronic payments are becoming increasingly more popular as they are secure, cost-efficient, and provide faster, automated tracking and payments. It’s now becoming standard practice for companies to take advantage of digital payments.

Step 6: Receipt of Canceled Checks

In the event that payment was made via check, companies should wait for the canceled check to arrive before indicating that the payment process is completed. This is important for legal and audit purposes, as the canceled check is the only evidence that the payment has been issued and received by the vendor.

Step 7: Vendor Statement Reconciliation

On a more frequent basis, companies should also reconcile their vendor statements to ensure that all payments have been properly received. This process is especially important for larger companies that regularly purchase goods and services due to the higher potential for errors in accounts payable. It also helps to strengthen the bonds between companies and their vendors by ensuring that any discrepancies or issues in payments can be resolved quickly.

Step 8: Releasing Year-End Financial Reports

At the end of the financial year, companies review their A/P records and create financial reports that reflect their financial standing as well as their payment activities to vendors. Such reports enable companies to assess their annual spending and forecast budget estimates for the upcoming year.

Step 9: Using Correct Software for Privacy and Compliance

Finally, A/P procedures must adhere to stringent privacy and privacy laws. To ensure that all data is kept safe and compliant with applicable regulations, companies must choose the right accounting and A/P software. Many of the best A/P solutions are equipped with encryption protocols and other security measures to protect the privacy of vendor and client information. The software should also provide real-time reporting and audit trails so that companies can quickly investigate any discrepancies or malicious activities.

Each step of the accounts payable process is essential to ensuring the efficiency and accuracy of a company’s financial operations. From the issuing of PO’s to the collection of canceled checks, companies must ensure that every step of the process is adequately documented and tracked. Doing so will guarantee that vendors are properly remunerated for their services and enable the company to gain an accurate overview of its financial standing.

Post a Comment for "What Is End To End Process Of Accounts Payable"